The exacerbated competition that is raging in the online hotel industry pushes those involved to adapt an aggressive commercial behavior, and an even more fierce distribution. In this sense, we note in recent months that Booking.com, via its new tool Booking.basic, markets units of some establishments whose stock belongs to third-party websites, including Ctrip and Agoda, whose rates are lower than those of Booking .com.

This practice, nowadays limited to certain specific markets (in particular Asia, where Ctrip has rates that defy all competition) could be generalized to all the markets, and cause major damages to the hoteliers, who would see their margins even more reduced.

Booking.basic, which still seems to be in the testing phase, could grant Booking.com additional capacity in terms of distribution, by having on the same platform at once unbeatable prices thanks to the already operational commercial tools (Secret Deal, Genius), but also rates of platforms whose pricing policy is focused first and foremost on volume. For this, the units marketed via Booking.basic are only Non-refundable, and do not give the final customer any possibility of modification by clearing itself of any liability. Moreover, a message to this effect is indicated to the customer when booking:

Booking.basic: You are able to make a Booking.basic reservation. Booking.basic reservations are facilitated by third party business partners. During the reservation process, we are required to share the information with the third party business partner. Please note the information provided in the booklet or the booking confirmation for more information about the third party business partner.

In summary, Booking.com offers very low prices that are not intended for it on its booking platform while indicating that the responsibility lies with a third party.

Why your hotel need a direct booking Solution?

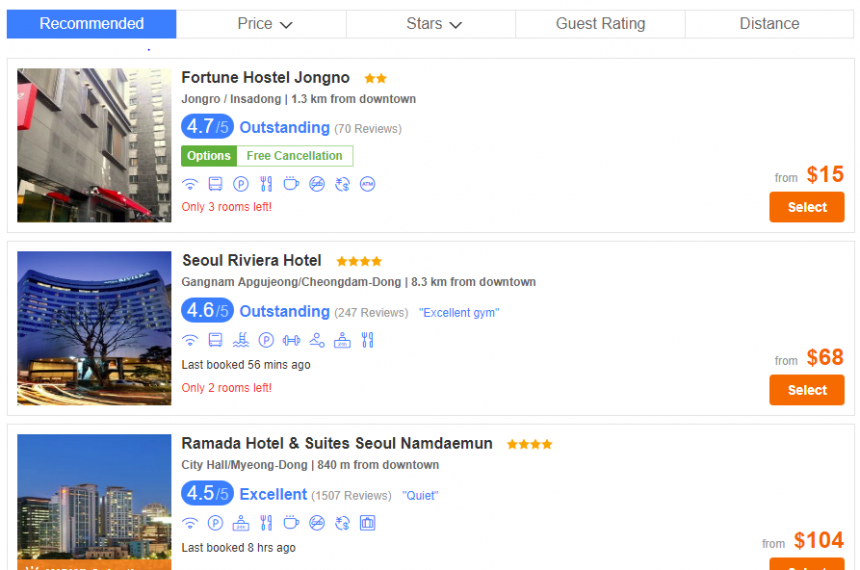

Faced with this situation, what option remains for hoteliers? DIRECT BOOKING. Because despite having an unbeatable commercial, and distribution capacity in the industry, in addition to visibility and prominence among global customers, Booking.com does not own commercialized rooms.

Hoteliers therefore have a weapon that is currently largely underutilized, in this case DIRECT BOOKING, which could prove fatal to the American giant. By taking control of their distribution via their website, which will of course have to measure up in terms of pricing, hoteliers would neutralize the negative effects of Booking.basic. Some major global chains, such as Accor or Hilton, have already started to improve their website in this direction, but they are at different stages today.

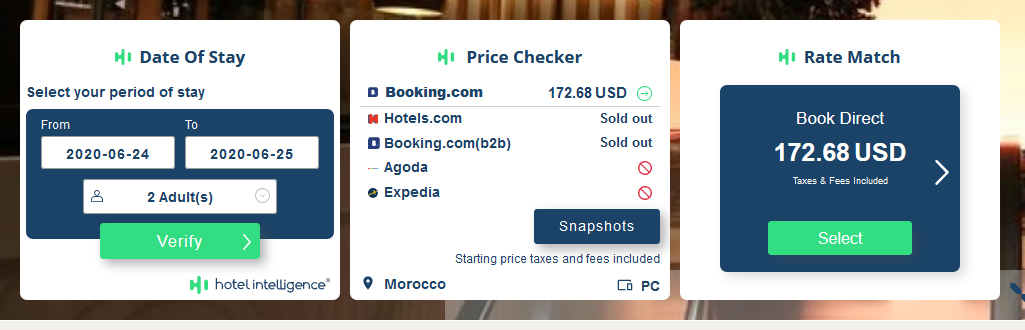

Boost the DIRECT BOOKING with the Rate Match System tool

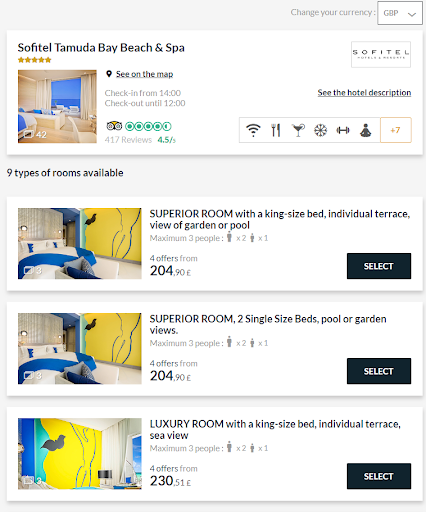

Some tools are now being developed by several technology startups in order to boost DIRECT BOOKINGS, such as Rate Match System by Hôtel intelligence, which allows you to have at all times the best price available from OTAs within the official website using a Data Mining technology.

Solutions therefore exist to counter aggressive and unfavorable practices in terms of net margin for hoteliers. However, all these alternatives go through a development of DIRECT BOOKING institutions, whether large chains or small independents.