In the second half of 2020, marked by what the Covid-19 crisis has represented and continues to represent for the hotel industry, all indicators suggest that we could witness the outcome of a war between hotel distributors that has been going on for several years now: knowing who will definitely lead the distribution between OTAs and the establishments themselves via their website has become vital.

Distribution channels.

There are many opportunities and ways to promote and distribute your hotel. Hotels must rely on the online and offline channels available to attract, reach, convert and retain their customers. OTAs and meta search can be decisive regarding the number of reservations a hotel can have. For hotels, it is crucial not to deprive themselves from such a large potential customer base. The second and main distribution channel is the hotel’s own website. An efficient interface and booking engine can allow hoteliers to increase and accept direct bookings more easily, but above all, to create a personalized customer experience that is much more adapted to the expectations of future consumers. Mobile and social networks represent a channel whose market has started from very low but is, today, quickly developing and will take the lead in the future. Reservations by phone and in live property are still requested by older generations. It is therefore important to continue to offer quality service to this target segment. The 4th channel is represented by tourist wholesalers and tour operators. They act as an intermediary between agencies and hotels and ensure good exposure and visibility in the market for less human capital and financial investments.

Hotel industry’s key players and Covid-19.

Today, it is undeniable that OTAs are the champions of online sales with market shares nearly reaching 80% in Europe for the two leaders, Booking.com and Expedia. The two distribution mastodons can also boast about having double-digit annual growth rates over the past decade thanks to commissions ranging from 10% to 30% for each reservation. However, the coronavirus has involved many disruptions that suggest a reversal of this trend. For survival purposes, hoteliers must reduce the impact of OTAs commissions on their revenues: the exponential drop in bookings as well as the low visibility on upcoming events require from them to defend their profits as much as possible.

On the consumer side, the situation has also changed. Whether they find the best price or not, they are starting to understand the importance of direct bookings for hoteliers. Consumers are gradually becoming aware that these are not only an income for the hotel but the jobs and future of all the hotel staff. In any case, tariff policies remain the sinews of war.

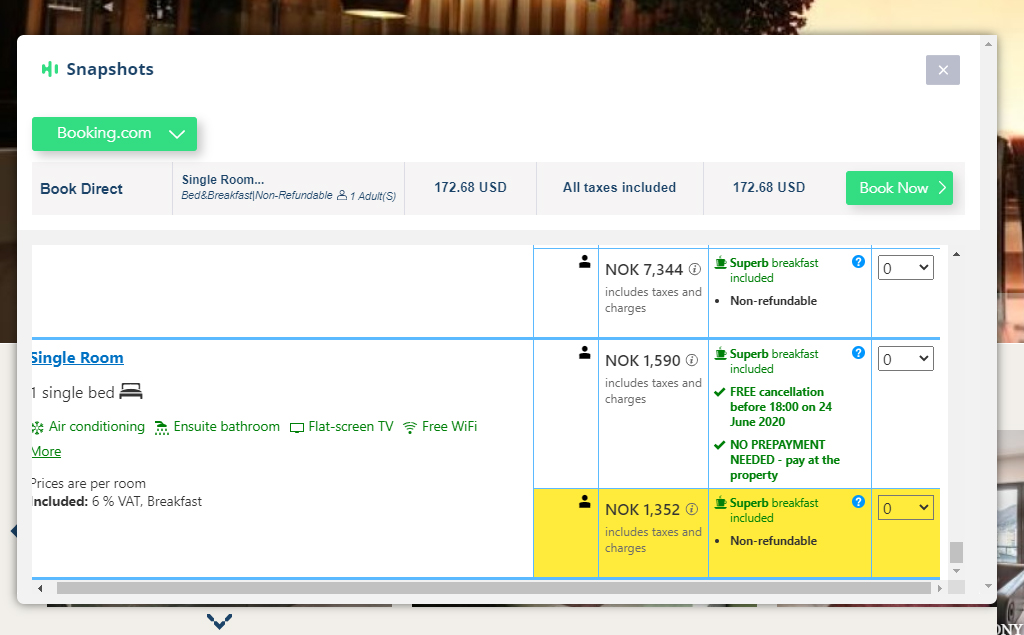

The greatest strength of OTAs compared to hoteliers lies in the fact that they geo-locate and “device target” consumers; they can vary the pricing depending on the travellers’ device (mobile, computer, tablet, etc.) but also depending on the country in which it is located. These two elements make it almost impossible for hoteliers to align their rates with those of distributors. Moreover, if you add to this the optimized user experience of their websites in 40 languages and 50 currencies, it becomes very difficult to capture more direct bookings for hoteliers.

OTAs: end of the dictatorship?

Large hotel groups and independent establishments no longer feel that they have control over their distribution. The prices proposed by OTAs are often lower than they should be, creating increasing tensions between the two parties. Moreover, the commission rates charged and dictated by the OTAs can impose higher or lower rates on institutions, depending on their status. These actions, considered as abuses, have led governments to defend their hotel industry. This is the case in Switzerland where the Swiss Parliament, which censored the clause imposed by Booking.com on hoteliers, is preventing them from marketing their nights at lower prices than those offered on the platform. Many European countries, such as France, Germany and Italy, should follow the path of the Swiss Parliament to protect their industry. Given the importance of the tariff policies implemented, this new situation could limit the growth of OTAs in these markets.

On the other hand, major reference hotel groups are increasingly focusing their recovery strategy post-covid-19 on Direct Booking. Some, like Marriott International, had started this a few years ago. The world-leading group in 2018, with more than 1,200,000 rooms, launched its “It pays to book direct” campaign in 2016, with a main objective of restoring consumer confidence concerning who offers the best price. According to Arne Sorenson, CEO of Marriott International, this is an absolute war to know who will win the customer and especially his information. In April, Karim Soleilhavoup, Chief Executive Officer of the Logis Hotels group, also raised this issue. With the support of the 2,400 independent hoteliers in Europe of the Logis Hotels group, and on behalf of the 17,000 independent hoteliers in France, who represent 82% of the French hotel industry, Karim Soleilhavoup denounces the practices of booking platforms such as Booking, Expedia, Egencia, etc. during the Covid-19 crisis. To save local jobs, Logis Hotels is asking businesses and individuals to mobilize and book their next post Covid-19 nights directly with through the hotels’ websites.

The coronavirus crisis has only accelerated this process in most hotel chains. Protecting your income by balancing this power relationship between live booking and OTAs becomes a crucial issue when the institution’s survival depends on it.

Adjusting the balance between direct booking and OTAs.

For larger international groups, it is therefore a question of convincing consumers to change their consumption behaviour by offering them better rates, and more. Hoteliers have weapons that OTAs don’t: the possibility to offer gifts or discounts on services for a particular stay (airport transfer, meals, spa, late-check out, etc.) or offers on local attractions… These small gestures towards customers combined with a more ergonomic website and its design are non-negligible arguments to improve their Direct Booking. Launched for the most part 2 or 3 years ago, these campaigns reached maturity in 2020 and are beginning to bring tangible results to hotel groups.

Discover the Hotel Intelligence solution, specially designed and developed for hoteliers on https://hotelintelligence.io/.